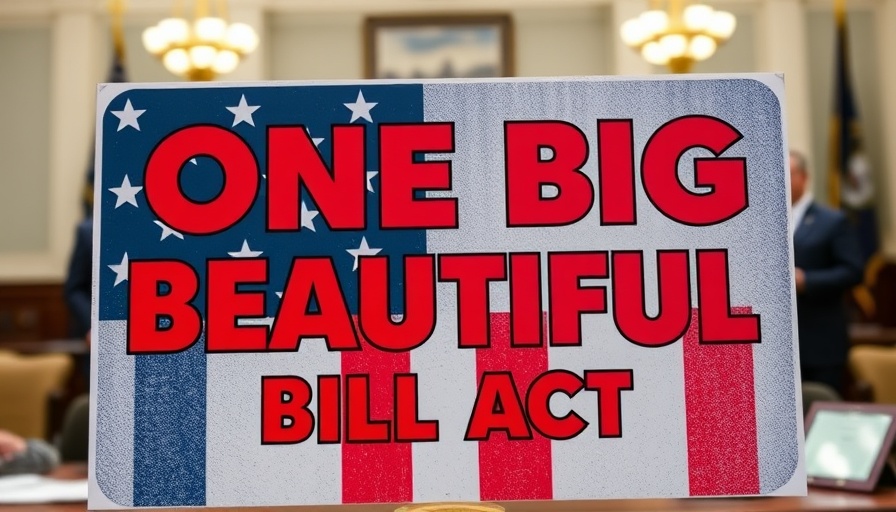

Understanding the One Big Beautiful Bill Act (OBBBA)

Passed on July 4, 2025, the One Big Beautiful Bill Act (OBBBA) has stirred numerous discussions with its sweeping tax reforms and extensions. From its party-line backing in Congress to President Trump’s signature, this legislation aims to have broad implications on both individual taxpayers and the overall economy. In this article, we will delve into the key components of the OBBBA, its expected impact, and the underlying financial dynamics that warrant your attention.

Significant Tax Cuts Extended by the OBBBA

The OBBBA has notably extended nearly all the temporary tax cuts established by the Tax Cuts and Jobs Act (TCJA) of 2017. This was a strategic move to maintain lower tax rates and incentives, especially for higher-income brackets and corporations, in a climate increasingly beset by calls for fiscal responsibility. The extension of these cuts, with a projected cost of $4.6 trillion over the next decade, suggests a significant commitment to maintaining a favorable tax environment.

The Financial Overhaul: A Deeper Look

Among the most impactful tax cuts made permanent under the OBBBA are:

- Lower Tax Rates: A permanent extension, primarily benefiting higher earners, costing approximately $2.193 trillion over ten years.

- Capital Gains Tax Rates: Continued alignment with lower marginal tax rates to support investment.

- Expanded Standard Deduction: Amounts have been notably raised, including $15,750 for singles and $31,500 for married couples, at a cost of $1.425 trillion over the decade.

- Child Tax Credit Expansion: Maximum Child Tax Credit amounts increased from $2,000 to $2,200, introducing a necessary Social Security number requirement.

- Permanently Extended AMT Exemption: This continues to shield taxpayers from the Alternative Minimum Tax burden, costing $1.363 trillion.

Funding Cuts and Financial Impact on the National Debt

While the OBBBA heralds expanded tax benefits, it does so against a backdrop of significant challenges. The decision to cut previous funding sources raises pertinent questions about the sustainability of such fiscal policies. As tax cuts proliferate, the national debt is projected to increase, necessitating a discussion about long-term economic health and potential repercussions on taxpayers and services in the future.

Making Sense of National Fiscal Policy

This broad repositioning of tax obligations has ignited debates regarding its compatibility with the federal government’s budgetary constraints. As much as the legislation claims to benefit individual taxpayers by increasing disposable income, there’s an emerging narrative cautioning against potential ramifications on public services funded through taxation.

The Broader Economic Landscape: Trends and Predictions

As the OBBBA rolls out in tandem with burgeoning global economic challenges, such as inflation and supply chain disruptions, it is critical for taxpayers to remain informed. Economic analysts predict that while immediate benefits like increased spending power will be visible, the long-term effects, including potential tax increases or cuts to social programs down the line, could dilute these advantages.

Conclusion: A Call for Awareness

In summary, the One Big Beautiful Bill Act is poised to significantly alter the financial landscape in the coming years. While it offers substantial benefits primarily to higher earners and businesses, taxpayers must remain vigilant regarding the sustainability of these policies and their implications on the national debt. Understanding these financial dynamics enables citizens to navigate the complexities of their own finances more effectively. Stay informed, as your knowledge of these changes will arm you with insights to better manage your personal and household finances moving forward.

Add Row

Add Row  Add

Add

Write A Comment